Are you worried about what might happen if your aging parent faces a sudden health or legal emergency? Believe me it can and does happen all the time. As adult children and caregivers, it’s natural to want the best for our elderly loved ones. But far too many people are caught unaware, then face the overwhelming stress of mandatory court proceedings adding fear, expense, and delay to an already fragile time. At For My Parents Care, I know that getting your parents’ affairs in order through early elder care planning is one of the most important steps you can take to protect their well-being and your peace of mind.

Why Early Legal & Financial Planning for Elderly Parents Matters?

I understand how important this is because I lived it firsthand. I saw the path my mother was heading down, and I knew that waiting would only make things harder for me and everyone involved. At the same time, it was clear that my father, though loving and devoted to her, was overwhelmed and distressed by the complexity of legal and financial matters that was inevitable and needed attention. Preparing early gave us clarity in the midst of uncertainty. While these issues can feel intimidating, addressing them through structured elder care planning allows everything to be organized, thoughtful, and far more manageable freeing families to focus on care, connection, and what truly matters.

Avoiding Crisis Mode

Without proper planning, families often scramble during a medical emergency or sudden decline. Many hospitals and care facilities cannot accept instructions from anyone but the patient without legal documents like powers of attorney and advance directives. These are essential for making timely decisions about care, finances, and necessary medical treatment.

Preventing Legal and Financial Roadblocks

If your parent becomes incapacitated and hasn’t named a financial or healthcare power of attorney, you may need to go to court to gain authority—delaying critical decisions and access to funds. Having to involve the courts takes time and money as attorneys are needed quickly to address the courts on your behalf.

Protecting Assets and Reducing Stress

Organizing wills, trusts, and beneficiary designations can help avoid expensive probate, protect family assets, and ensure your parents’ wishes are honored. This preparation also reduces family conflict and emotional stress during difficult times.

Essential Legal & Financial Documents for Elder Care Planning

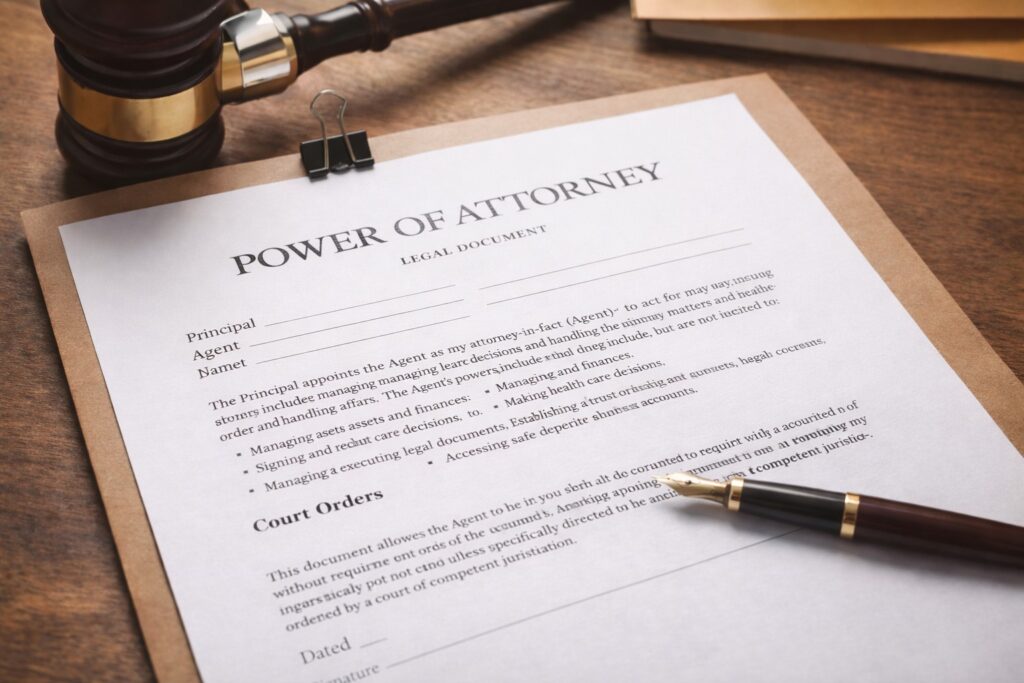

When families begin thinking about legal planning for an aging loved one, it’s often unclear where to start or what documents even matter. While every situation is unique and legal advice should always come from a qualified professional, there are a few foundational documents that commonly help families navigate care decisions with clarity and confidence. The examples below are meant to offer a simple starting point—just a snapshot of the types of legal tools that can help protect your loved one’s wishes and spare families from unnecessary stress during already difficult moments.

- Last Will and Testament or Living Trust

- Durable Power of Attorney (for finances)

- Healthcare Power of Attorney (medical proxy)

- Advance Healthcare Directive/Living Will

If you’re not sure where to begin, I’ve created a simple Elder Care Planning Checklist to help families organize key information at their own pace. Feel free to check it out here and use it to help organize your elderly loved ones’ affairs.

Conversation Starters: How to Talk to Your Parent About Planning?

Starting the conversation can be tough. There’s a fine line between respecting a loved one’s autonomy and gently preparing for what may lie ahead. Ensuring they’re protected when important decisions can no longer be delayed is paramount for their care. Try these gentle prompts:

- “Mom/Dad, I want to make sure we’re prepared for anything. Can we talk about your wishes?”

- “If something unexpected happened, how would you want decisions to be made?”

- “Do you have any important documents or plans I should know about?”

- “Would you like to meet with a professional together to review your plans?”

Approach with empathy and respect, emphasizing your desire to honor their wishes.

Organization Tips for Caregivers

- Use a checklist to gather all necessary documents.

- Store originals and copies in a secure, accessible place (consider digital backups).

- Keep a contact list of your parent’s attorney, financial advisor, and insurance agents.

- Review and update documents regularly.

- Share the location of documents and passwords with trusted family members.

- Use organizational tools or apps designed for elder care planning.

When to Seek Professional Help?

Do-It-Yourself legal forms can lead to costly mistakes. At For My Parents Care, I connect families with trusted elder law attorneys, financial planners, and caregiving resources in your area. I understand the unique challenges adult children face and am here to guide you every step of the way.

It’s wise to to consult an elder law attorney or financial planner for guidance at any stage, and particularly if you’re facing any of the following circumstances:

- Your parent owns property in multiple states or has complex assets.

- There are blended family dynamics or estranged relatives.

- You’re unsure about Medicaid, Medicare, or long-term care planning.

- You want to ensure all documents are legally sound and up to date.

What Can You Do Now?

Don’t wait for a crisis. Start the conversation with your parent today. Download our free Elder Care Planning Checklist or contact me to schedule a consultation with a local elder law professional. Share this post with siblings or other caregivers to get everyone on the same page.

Conclusion

Proactive legal and financial planning is one of the most meaningful acts of care we can offer our aging parents and ourselves. When plans are put in place early, families are spared the emotional strain, financial disruption, and expensive and time-consuming court involvement that so often arise during moments of crisis. Instead of panicking and scrambling for authority or answers, you gain clarity, confidence, and the ability to act in your loved one’s best interest when it matters most.

Planning ahead is not about expecting the worst; it’s about preserving dignity, honoring wishes, and protecting family harmony. Thoughtful elder care planning ensures that decisions are guided by intention rather than urgency, keeping your parent’s voice central even if they can no longer advocate for themselves. It also gives families and caregivers peace of mind knowing they are prepared, supported, and not forced into difficult legal or financial situations during an already emotional time.

Cay, How Can You Help?

If you’re not sure where to begin with elder care planning, I’ve created a simple Elder Care Planning Checklist to help families and caregivers organize essential legal, financial, and care-related information at their own pace. It’s designed to ease stress, clarify what may be needed for aging parents, and provide a calm, practical starting point without pressure to have everything figured out at once. Want to know more about me? You can visit this page – Who Am I.

Recent Comments